Monthly Market Review

Throughout 2025, the U.S. economy proved more resilient than many experts expected, despite inflation concerns, political uncertainty, and shifting monetary policy.

Regardless of political or economic developments, we will continue to focus on long-term value creation, supported by prudent short-term liquidity management, to ensure that our portfolios remain resilient across a wide range of potential outcomes.

A Hidden Blessing: Funds Your Church May Not Know It Has

The holiday season reminds us that some of the best gifts are the ones we never expected.

A quick online search shows that many churches, ministries, and agency partners have unclaimed funds listed on MissingMoney.com.

Taking a few minutes to search your organization’s name could uncover unexpected support for your mission and ministry.

Monthly Market Review

Despite various market concerns, all but two of our portfolios experienced positive gains in November, as the diversification of our portfolios continues to provide resilience against prevailing market conditions.

Regardless of the current political and economic circumstances, we will continue to maintain a disciplined approach to long-term value creation and prudent short-term liquidity management.

Growing Generosity

As we remember Cathy, we honor not only her generosity but the spirit of service and joy in which it was given. Her life and gift remind us that investing in ministry and in our communities is an act that echoes and touches lives for years to come.

Monthly Market Review

In October 2025, our portfolios experienced another positive month as markets continued to respond favorably to optimism around artificial intelligence, easing inflation, and a more supportive stance from the Federal Reserve.

As we head into the final quarter of 2025, Faith Foundation and our asset management partners continue to actively monitor evolving geopolitical and economic conditions to safeguard our clients’ interests. Our portfolios remain positioned for long-term growth and short-term liquidity.

A New Chapter of Ministry: Marine Drive Childcare Opens in Bremerton

When congregations like Bremerton UMC borrow through the Foundation, the interest they pay goes to every congregation that has invested their “rainy day” funds in the Stable Value Portfolio. This cycle of generosity allows every dollar to work twice: once for the borrowing congregation, and again for others who benefit through shared returns.

Remembering and Honoring Darrell Lowe

With deep gratitude and sadness, Faith Foundation Northwest remembers the life and service of our beloved board member and friend, Darrell Lowe, who passed away peacefully on September 7, 2025, at the age of 89.

We give thanks for Darrell’s life, his faith, and his many gifts of leadership. Though his presence will be deeply missed, his legacy of faith, generosity, and joyful service will continue to inspire our work for years to come.

Faith in Action: Parsonage Electrification Advances Our Carbon Commitments

At Faith Foundation Northwest, we know that generosity and stewardship can transform our ministries and communities. We recently got to see firsthand that it can also transform the spaces we share and homes that we make.

Thanks to funding from the Washington State Department of Commerce’s Home Electrification and Appliance Rebates Program (HEAR), we recently completed the fourth round of grants, bringing a total of 55 high-efficiency electric installations to 22 parsonages across Washington State.

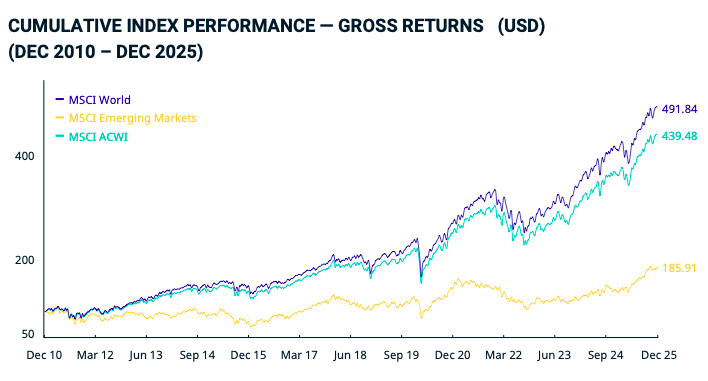

Understanding U.S. Equity’s Historical Outperformance: A Case for Balanced Global Exposure

While international stocks have been in favor in 2025, U.S. equities have dominated global markets for over a decade. But is this historical outperformance built to last? In Wespath’s latest blog, Joe Halwax and Jon Morris unpack the three key drivers behind the U.S. dominance and make a compelling case for renewed global diversification.

Understanding the U.S. Dollar’s Recent Declines and What It Means for International Equity Performance

Wespath’s latest Investment Insights blog explores how a 10% drop in the U.S. dollar is fueling international equity gains, challenging investor assumptions, and redefining diversification strategies.

A Fond farewell to Dalcetta

This month we are saying a fond farewell to Dalcetta Palepale, who has served on our staff as Outreach and Development Specialist since November of 2023. Dalcetta’s positivity lit up our weekly team meetings, and her care and compassion shone through every time she worked with a faith community on the Foundation’s behalf. Please join us in wishing her all the best! Moving forward, you can find Dalcetta at the Burke Museum’s “In The Artist’s studio” events, where her work is featured in the Oceana collection.

What You Should Know About the Bloomberg U.S. Aggregate, Wespath’s New Fixed Income Benchmark

Wespath is adopting the Bloomberg U.S. Aggregate Index as the new benchmark for its Fixed Income Fund and Social Values Choice Bond Fund, enhancing transparency and aligning with industry standards. Hear from Connie Christian (Manager, Fixed Income) and Myles Smith (Investment Analyst) about how this shift empowers investors to better evaluate performance without changing the funds’ core strategies in their latest blog.

A Pause in U.S. Exceptionalism: Shifting Dynamics in Global Markets

The U.S. has long dominated global equity markets. However, a strong start to the year from international stocks suggests that may be changing. In Wespath’s latest Investment Insights blog, Joe Halwax and Raj Khan examine this shift, its causes, and whether it may be a temporary pause or rather a fundamental shift away from U.S. exceptionalism.

A Message from the CIO on Recent Stock Market Volatility

We understand recent market volatility due to tariff announcements and rising trade tensions can feel unsettling. In this message from Wespath’s CIO, Johara Farhadieh reflects on the impact of these market events and shares a reminder on the enduring principles of long-term investing.

5 POTENTIAL IMPACTS OF TARIFFS AND TRADE POLICY

We understand that the transformative shifts in trade policy highlight the critical importance of portfolio diversification. The evolving global landscape—with its dynamic trade relations and rapidly changing policy environments—strengthens our commitment to constructing diversified investment portfolios that can endure various scenarios.

Grants for energy-efficient building upgrades

Nonprofits are now eligible to apply for up to $100,000 in federal funding for energy-efficient building upgrades through the Building Upgrades Inspiring Local Transformation (BUILT Nonprofits) program. This is the best grant opportunity we’ve seen so far for churches who need to upgrade their HVAC systems!

Pledge Campaign Best Practices

Cesie Delve Scheuermann of Inspiring Generosity and Julia Frisbie of Faith Foundation Northwest teamed up to teach an interactive class rich with real-world examples from our own episcopal area.

If you could not make it or would like to watch it again, the recording is available now on demand at the following link: Click here to access this recording.

Mini Grants for Mission

Faith Foundation Northwest is thrilled to announce a new mini-grant program, through which faith communities in Alaska, Idaho, Oregon, and Washington are eligible to apply for $1,000-$3,000 of unrestricted funding to help them carry out their missions. Applications are due September 30, 2024.