Monthly Market Review

U.S Overview

Throughout 2025, the U.S. economy proved more resilient than many experts expected, despite inflation concerns, political uncertainty, and shifting monetary policy. Though inflation remained above average, it did, however, continue to move lower over the course of the year, though progress was uneven and prices for certain services and products--such as housing, healthcare, travel, and groceries--remained higher than historical averages.

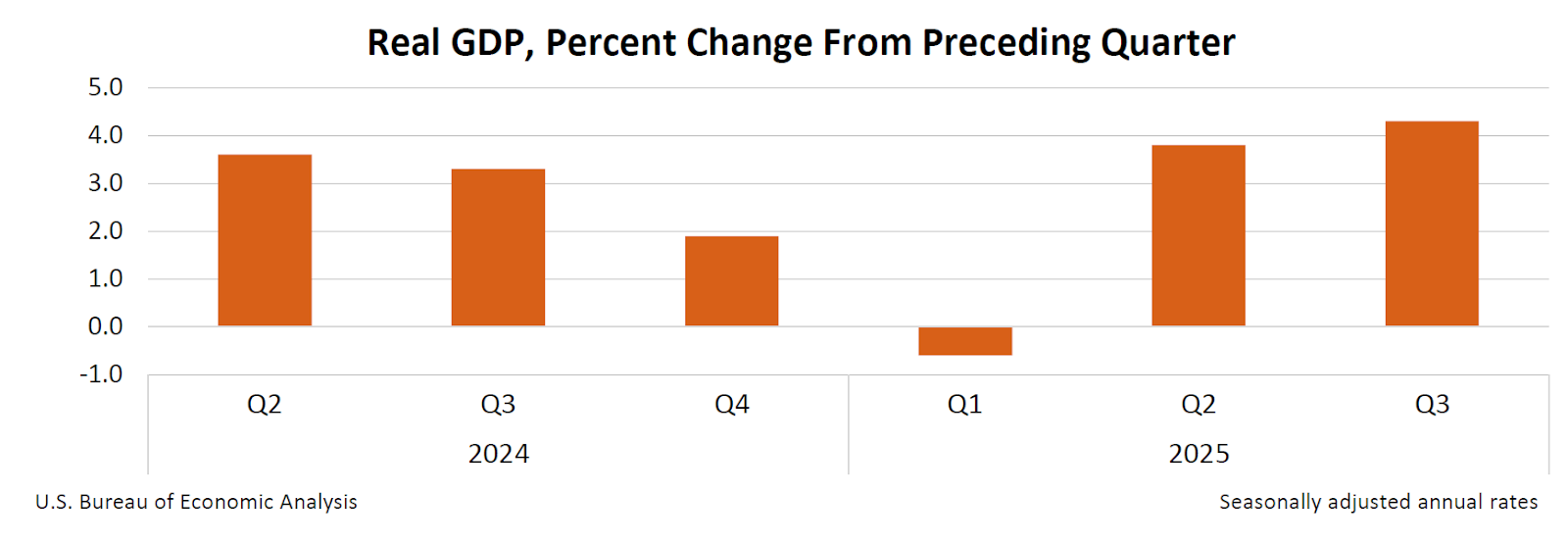

Economic growth slowed from the rapid pace of earlier years but stayed firmly positive, supported by steady consumer spending and ongoing business investment. Unexpectedly, economic growth accelerated mid-year, with the economy expanding at a 4.3% annualized rate in the third quarter, the fastest pace in two years.

However, the GDP growth figures are not reflective of uniform economic growth, as demonstrated by a sluggish labor market. Hiring slowed and unemployment rose to 4.6% by late 2025, the highest in four years.

Despite a lengthy government shutdown that delayed some official inflation and employment data, the overall trend remained clear: inflation was still higher than ideal but moving in the right direction.

U.S. stock markets delivered strong results in 2025. Investor enthusiasm—particularly around artificial intelligence and technology—played a major role in market gains, especially early in the year. As valuations in the tech sector reached questionably high levels, markets experienced periods of volatility and a shift toward more reasonably priced sectors.

International Overview

Outside the U.S., global markets in 2025 were shaped by ongoing trade and tariff uncertainty, which weighed on manufacturing activity worldwide—particularly in parts of Asia.

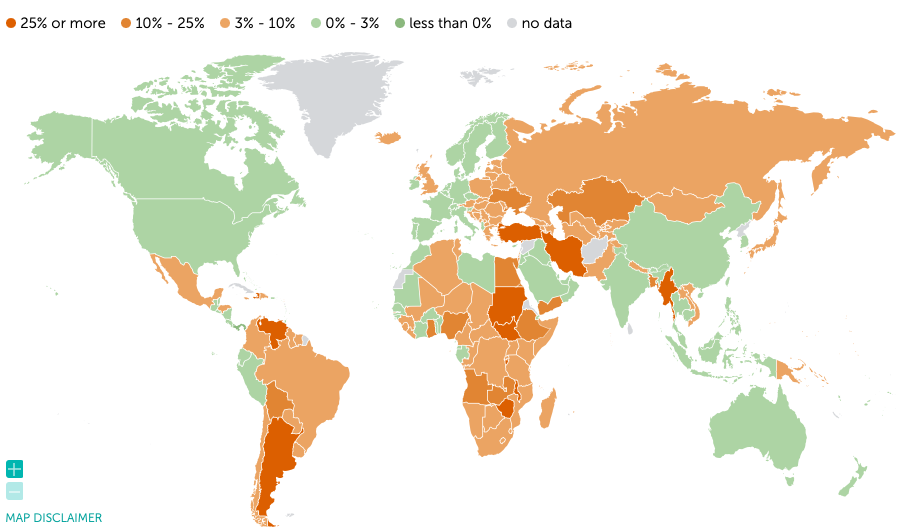

Inflation trends across the region remained mixed, with many Asian economies experiencing relatively high but stable inflation, while others began to see easing price pressures.

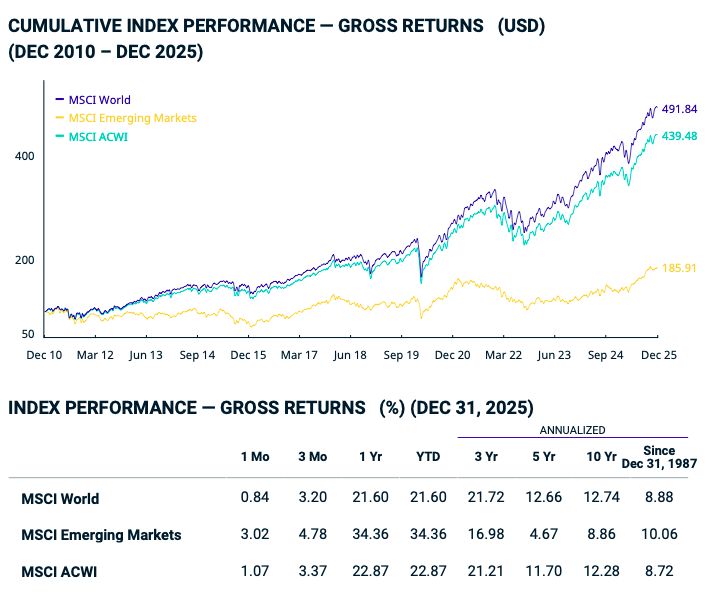

Global stock markets performed well overall despite these challenges. The MSCI All Country World Index, which tracks both developed and emerging markets, rose more than 20% for the year, reflecting broad global equity strength.

In several regions, international markets unexpectedly outperformed the U.S. For example, the UK’s FTSE 100 rose approximately 21.5% in 2025, its strongest annual performance since 2009, supported by gains in commodity-related and defensive sectors.

Emerging markets benefited at times from a weaker U.S. dollar, which helped ease currency pressures. However, some countries continued to face challenges related to high debt levels, but several African economies made meaningful progress on inflation control, allowing central banks in countries such as Kenya and South Africa to cut interest rates by year-end.

In Europe, inflation remained relatively stable throughout the year, with modest increases largely driven by service sector prices. At the same time, economic growth remained sluggish, and increased government spending, particularly on defense, added strain to public finances. Even so, European trade and commerce proved more resilient than expected despite ongoing policy uncertainty.

Overall, global economic data in 2025 was mixed but generally stable, reflecting an international economy navigating geopolitical and policy challenges without significant disruption.

What does this mean for you?

Despite periodic market volatility and rapidly shifting geopolitics, all our market-based portfolios delivered positive double-digit returns in 2025. Notably, all three of our Fossil Free Portfolios beat their benchmarks. As always, diversification remained a key contributor to our performance, helping portfolios mitigate sector-specific pullbacks while participating in broader market gains.

Steady U.S. consumer activity, improving fixed-income performance later in the year, and a rotation away from the most highly valued AI-related stocks and toward more attractively priced assets all played a role in our portfolio performance. This balanced approach allowed us to manage risk while remaining positioned for long-term growth.

Looking to 2026

As we look toward 2026, the economic outlook remains somewhat uncertain. Key issues we are monitoring include:

Global and U.S. tariff policy

Interest rate expectations

Housing market trends

Geopolitical developments, including Venezuela

The upcoming U.S. midterm elections

In the months ahead, additional clarity may come from a pending Supreme Court ruling on presidential authority to impose tariffs, as well as the expected appointment of a new Federal Reserve Chair—both of which could influence inflation, interest rates, and global trade policy.

Regardless of political or economic developments, we will continue to focus on long-term value creation, supported by prudent short-term liquidity management, to ensure that our portfolios remain resilient across a wide range of potential outcomes.

As always, thank you for your continued trust and support. It is our privilege to serve as stewards of your financial assets. We hope 2026 brings you and your family love, joy, and peace.

Sincerely,

The Faith Foundation Team